Runwal Enterprises Gets SEBI Nod for Rs.1,000 Crore IPO

Introduction

Mumbai-based developer Runwal Enterprises has secured approval from the Securities and Exchange Board of India (SEBI) to raise Rs.1,000 crore through an initial public offering (IPO). The issue will be a fresh equity share sale, with no offer-for-sale component, aimed at supporting the company’s expansion and strengthening its balance sheet.

Key Highlights

IPO Structure: Fresh issue of equity shares, face value Rs.2 each. No OFS component.

Allocation: 75% reserved for Qualified Institutional Buyers, 15% for non-institutional bidders, and 10% for retail investors. Employee quota will include a discount.

Pre-IPO Placement: Provision for raising up to Rs.200 crore before the IPO, with adjustment in fresh issue size if exercised.

Company Portfolio:

15 completed projects, 25 ongoing, and 32 upcoming as of Sept 2024.

48.71 million sq. ft. total developable and estimated developable area.

Diversified presence across residential, commercial, retail, and educational segments.

Market Share:

Ranked second in Mumbai (2019–2024) with ~5.7% share in launches and ~5.3% in sales.

Held dominant share in Kalyan-Dombivli with ~18% of sales and ~21% of new launches.

Financial Performance:

FY24 revenues: ?662.19 crore, up 188% YoY.

FY24 PAT: ?107.28 crore.

H1 FY25 revenues: ?270.52 crore; PAT: ?25.53 crore.

Listing & Management: To be listed on BSE and NSE. Managed by ICICI Securities and Jefferies India, with MUFG Intime India as registrar.

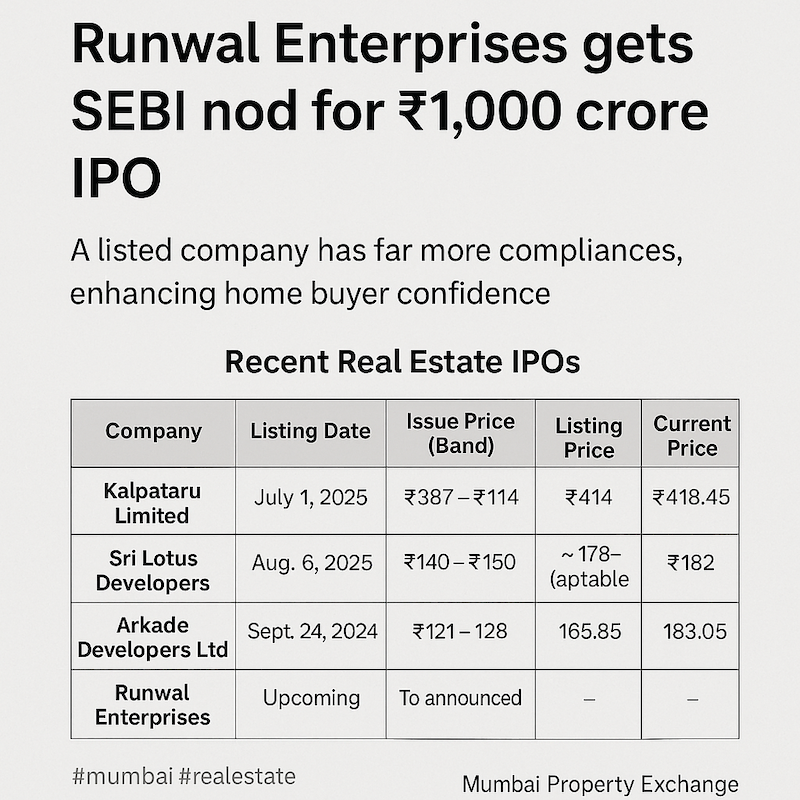

How Runwal Compares with Recent Real Estate IPOs

In

💬 Comments